Effective collection practices are crucial for the financial health and sustainability of any organization. In the evolving business landscape, moving from reactive to proactive collections management is essential. This shift not only ensures a stable cash flow but also strengthens customer relationships and reduces risks. This article explores the importance of efficient collection strategies for robust financial health and offers key best practices for optimizing collection processes in today’s global, technology-driven business environment.

Collections and Working Capital Optimization

Minimizing the time between a sale and payment receipt is crucial for optimizing working capital. Efficient collections processes enable organizations to reinvest in growth opportunities, manage inventory effectively, and enhance overall operational efficiency.

Companies that effectively manage their collections can significantly reduce Days Sales Outstanding (DSO), freeing up cash flow and improving Days to Cash (DTC). Hence, it makes total sense that businesses utilizing optimized collections processes are more likely to meet their financial targets.

Balancing Local Collections vs. Global Standardization

Many global organizations face the challenge of balancing local collection practices with global standardization – this is essential for achieving uniformity and efficiency. Effective collections management streamlines processes, reduces discrepancies, and ensures a steady cash flow, supporting broader operational goals – standardized collections practices can significantly improve working capital performance.

However, managing local collections versus global standardization is often challenging. Global standardization aims to create consistent processes, products, and branding across all markets, leading to economies of scale, simplified operations, and cohesive communication. Conversely, localization tailors strategies to meet the specific needs and preferences of local markets, enhancing cultural relevance, regulatory compliance, and user experience. Organizations often find that a hybrid approach, blending elements of both standardization and localization, allows them to leverage the efficiencies of standardization while remaining adaptable to local market demands. In today’s tech-oriented business environment, it’s easier to implement such a hybrid approach with the help of automated solutions.

Assignment Prioritization

Task prioritization is critical for effective collections and working capital management. Without a clear prioritization framework aligned between sales, customer success, and finance teams, identifying and focusing on the most critical and high-impact tasks can be challenging, leading to scattered efforts and poor resource allocation. Implementing a robust prioritization strategy and conducting risk-based assessments, helps A/R teams focus on high-priority accounts first, ensuring timely payments. This structured approach improves collections performance and enhances overall financial health and profitability for the organization.

Collections and Risk Mitigation

Proactive collections are key in effective risk management, especially around credit risks. Identifying potential issues early on allows organizations to minimize the risk of defaults, avoid legal challenges, and ensure compliance with regulations. Evaluating credit risks should consider not only the customer’s financial situation but also broader factors such as geographic exposure and overall business unit performance.

Furthermore, without clear insights into the status of collections, it is challenging to effectively allocate resources, prioritize high-risk accounts, and develop strategic interventions to mitigate potential losses. The absence of real-time data and comprehensive reporting can also hinder communication and coordination among departments, leading to fragmented efforts and inefficiencies.

To enhance risk management, organizations need to invest in robust collections management systems that provide real-time visibility, detailed analytics, and automated reporting.

Collaboration Between Finance and Business Units

Effective collaboration between finance and business units strengthens the overall business and reduces surprises for management around customer defaults. When finance teams work closely with sales, customer service, and operations, they gain a better understanding of customer behaviors and market trends, leading to more effective collections strategies. This collaboration ensures that collection practices align with broader business objectives, enhancing customer relationships, improving overall financial performance, and strengthening the finance department from a business perspective.

Collections and Future Planning

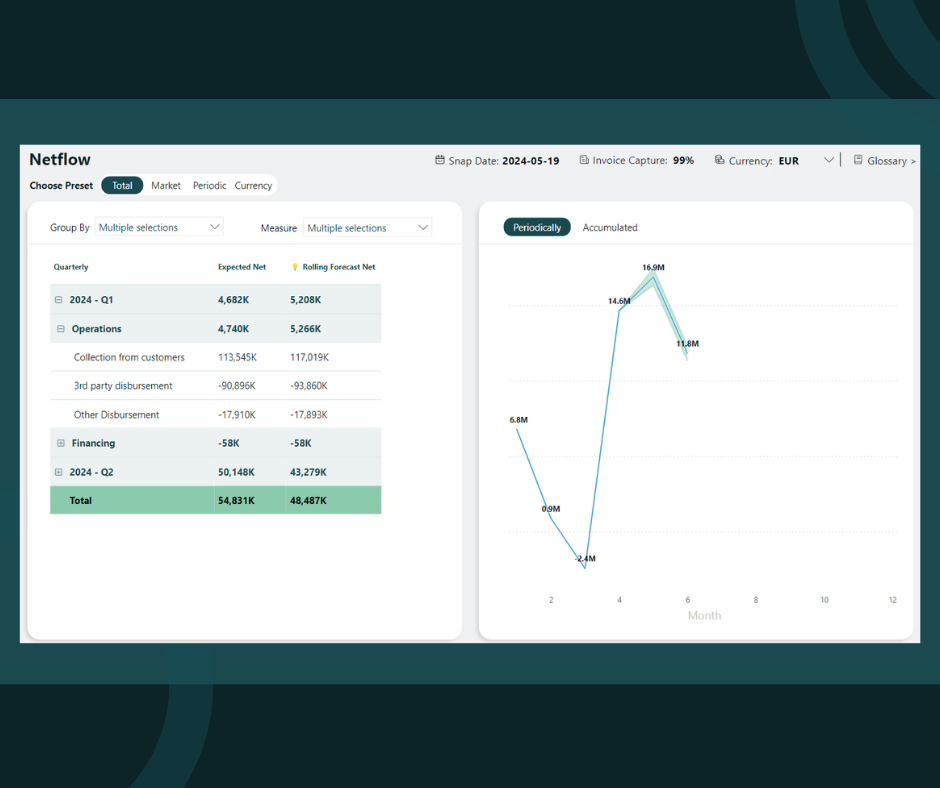

Accurate collection forecasting enables organizations to anticipate and plan for future cash inflows and even strategic direction. Effective collections management provides critical data and insights that inform future financial planning, helping organizations forecast cash flow, allocate resources, and set realistic financial goals.

By analyzing historical collections data, organizations can identify trends and patterns in payment behaviors, which can be used to predict future collections performance and adjust strategies accordingly. This foresight allows for better budgeting and financial planning, ensuring that sufficient resources are allocated to manage delinquent accounts and mitigate potential risks.

Additionally, a well-structured collections plan can highlight areas for process improvement and technological investments, further enhancing efficiency and effectiveness. Ultimately, integrating collections data into future planning enables organizations to make informed decisions, optimize their financial strategies, and maintain a stable economic footing.

Essential Best Practices to Optimize Collection Processes in a Modern World

#1: Incorporating a Billing Workflow

Creating a structured billing workflow tailored to your company’s policy is fundamental for effective collections management. Experience shows that companies employing a structured billing workflow can significantly reduce late payments, improving cash flow.

#2: Moving from ERP collection management to Automated Solutions

Transitioning from manual or ERP-based collection processes to automated solutions provides real-time insights into collections status, enabling proactive decision-making. Automation offers minute-by-minute updates, which are crucial for understanding financial resilience and managing cash flow effectively.

Relying solely on ERP for collections management is not optimal for mid to large corporations. AR automation that seamlessly integrates with ERP systems provides a single source of truth and can reduce Days Sales Outstanding (DSO) by up to 15%.

#3: Implementing Effective Monitoring and Auditing Processes

Robust monitoring systems should be implemented by headquarters to effectively oversee regional collectors, ensuring compliance and mitigating potential risks. Effective monitoring and auditing processes can significantly reduce risk exposure while improving compliance and overall financial stability.

Conclusion

Effective collections management is not just about ensuring timely payments; it’s about fostering financial stability, nurturing relationships, and mitigating risks. By embracing proactive approaches, leveraging automation, and prioritizing clear communication, organizations can optimize their collections processes, ensuring long-term financial health and sustainability.

OPYO’s collections module helps organizations transition from decentralized, reactive collection processes to a global, proactive, and centralized approach.

Discover how OPYO helped Taboola streamline their collections process and contact us to learn more about how OPYO can enhance collections management and drive financial resilience in your organization.